Tech’s appeal: are dynamic markets ready for digital investments?

Financial institutions in Europe and the Americas are muted about technology opportunities in dynamic markets. Are they looking in the right places?

Technology and digital transformation often provide compelling investment narratives. But new research shows that western financial institutions looking to invest or grow business in dynamic markets are taking a selective approach because the scale of the digital opportunity depends on the market

“As internet penetration deepens and we get rapid growth in 5G connectivity, the technology and fintech sectors should be the key drivers of growth in dynamic economies,” says Saif Malik, CEO, UK at Standard Chartered. “But in some markets, there needs to be investment in digital infrastructure to get them on to a more sustained growth trajectory.”

Some markets are not ready for tech investment

In research conducted by Standard Chartered and based on a survey of 400 Europe- and Americas-headquartered banks, investment managers and asset owners, interest in the technology and digital services sector is muted. Only 29 per cent say it is one of the three most important sectors to their future investment or business development plans. Almost every other sector in the research scores higher.

But there are some markets that investors are excited about. More than half say they are prioritising investment in technology and digital services in Cameroon (58 per cent) and in Saudi Arabia (56 per cent). And they are also attracted to the technology opportunities in Brazil, Singapore and India.

This data reflects the patchy digital infrastructure development in dynamic markets. In 2023, the World Economic Forum made the point that only 53 per cent of the world’s population has internet access. And it called for greater collaboration between the public and private sectors to encourage investment in connectivity. Policymakers will need to balance opportunities for economic growth with challenges such as socioeconomic division and inequality. Investment in innovation and human capital, meanwhile, will help to increase dynamic markets’ readiness for digital transformation.

Investors can find opportunities if they know where to look

These disparities mean investors in dynamic markets are focusing on finding the right technology and digital services opportunities. Amit Goel, Lead Portfolio Manager, Global Emerging Markets Strategy at US financial services multinational Fidelity, says that Asia is in a good position as cloud computing, 5G connectivity and artificial intelligence (AI) continue to evolve. “You have started to see the emergence of true global leaders out of Asia in the semiconductor manufacturing industry,” says Goel. India is vying to be one of those leaders.

Elsewhere, governments are working hard to secure their share of digital investment. In Brazil, for instance, the government’s new industrial policy centres on sub-sectors such as biotech and chip development, with $60bn of new investment. A number of countries including Mainland China, Singapore, Saudi Arabia and the UAE are establishing collaborative ecosystems for funding, research and innovation, a driver of investment or business development for 62 per cent of western financial institutions, according to the research.

“There are countries such as Saudi Arabia where you’re seeing clusters being established to create a great environment for technology start-ups to attract funding and move to the next level of growth,” says Christian Garbe, Global Head of Mergers & Acquisitions at DHL Group. The global logistics business has established a joint venture with Saudi oil giant Aramco, a supply chain hub for the energy, chemical and industrial sectors called ASMO, which leverages automation, AI and data analytics.

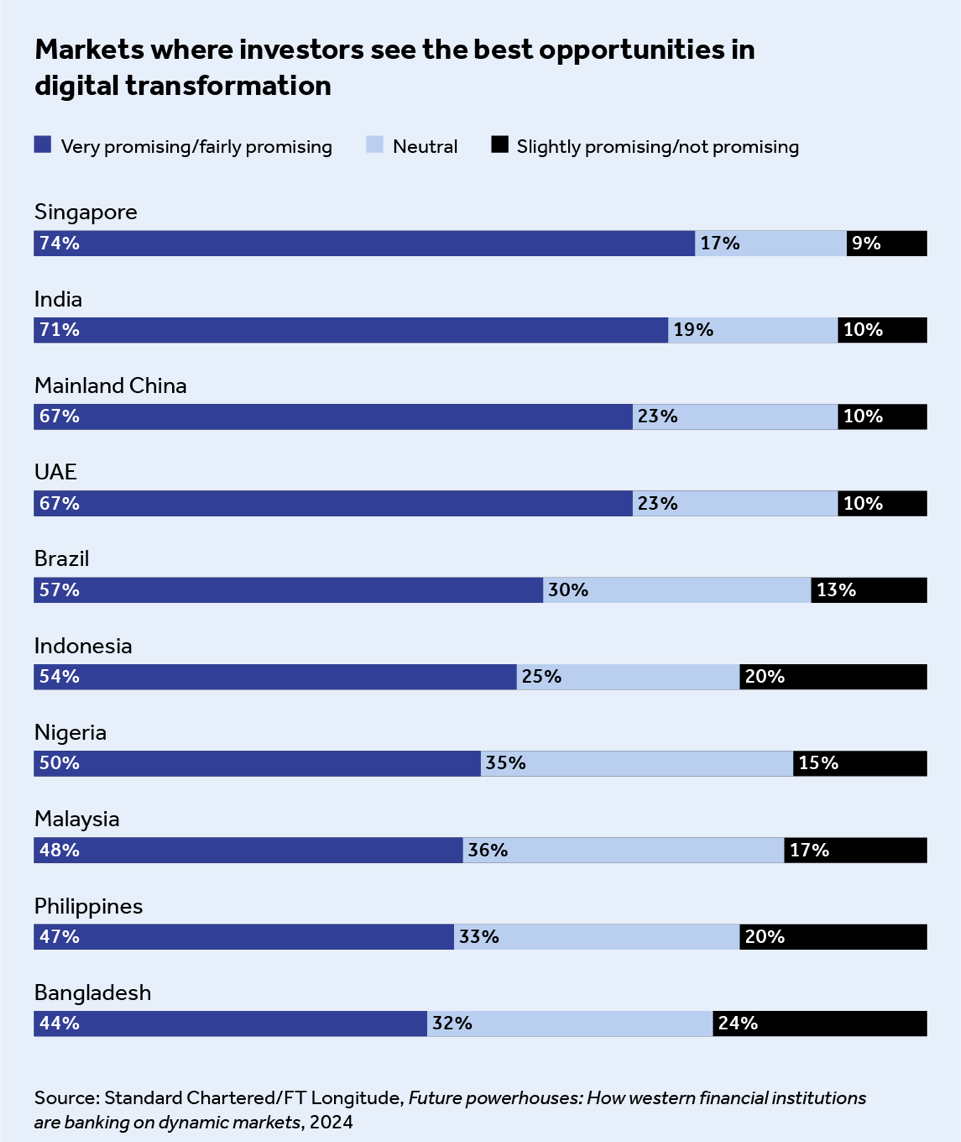

The existence of collaborative ecosystems may explain why financial institutions are most likely to describe opportunities related to digital transformation in certain markets as fairly or very promising.

The banking opportunity in dynamic markets

Investors are not the only beneficiaries of dynamic markets’ digital transformation. New technologies – AI, cloud computing, blockchain, the internet of things – are also changing the way banks operate in these markets, where newer entrants such as fintech firms do not have legacy system constraints.

“Technology plays a role in elevating markets higher in the value chain by enhancing customer experience, optimising operational efficiency, reducing costs and ensuring compliance with international banking regulations,” says Malik. “Combined, these technologies can lead to the creation of more sophisticated and competitive banking services that cater to the evolving needs of financial institutions in dynamic markets.”

The selective approach of western financial institutions underscores the need for strategies tailored to each market's unique opportunities. While the readiness for tech investments varies across dynamic markets, investors that are able to accurately identify and invest in countries with promising digital growth will reap substantial benefits.