India’s summer: why global investors are queuing up

With its dynamic economic growth and expansive sectoral investment opportunities, India is becoming a favoured market for western financial institutions. What is attracting investors in 2024?

India is closing in on Mainland China as western financial institutions’ most favoured market for investment and business development, according to new research . The country’s strong economic performance, rapid infrastructure development and supportive political backdrop are attracting growing numbers of investors – with a further boost from international companies wanting to diversify their supply chains.

"Our clients are increasingly drawn to India's long term economic prospects, highlighting its exceptional growth trajectory, vibrant digital ecosystem and significant reforms,” says Nicolo Salsano, CEO Europe, Standard Chartered & CEO, Standard Chartered Bank AG. “The consistent feedback we receive underscores a robust investor appetite, driven by the increasing confidence in the country's potential for high returns and sustainable development.”

Vivek Bhutoria, Co-Portfolio Manager of the Global Emerging Markets Equity Fund at asset manager Federated Hermes, notes the effect of supply chain diversification efforts. “Many companies are looking for a back-up option in addition to their operations in China,” he says. “India also provides a large domestic market for these companies.”

In research conducted by Standard Chartered and based on a survey of 400 banks, investment managers and asset owners headquartered in Europe and the Americas, 31 per cent of investors say that India will be a focus for their investment and development plans in the next 12 months. Mainland China, at 41 per cent, is still top of the list of favoured dynamic markets worldwide, but no other country comes close to India.

There should be plenty of opportunities in an economy that continues to outperform its rivals. Indian GDP grew 7.8 per cent in 2023, with expansion of 6.8 per cent expected in 2024. Mainland China, by contrast, managed only 5.2 per cent in 2023, and growth will slow to 4.6 per cent this year.

India appeals from several angles

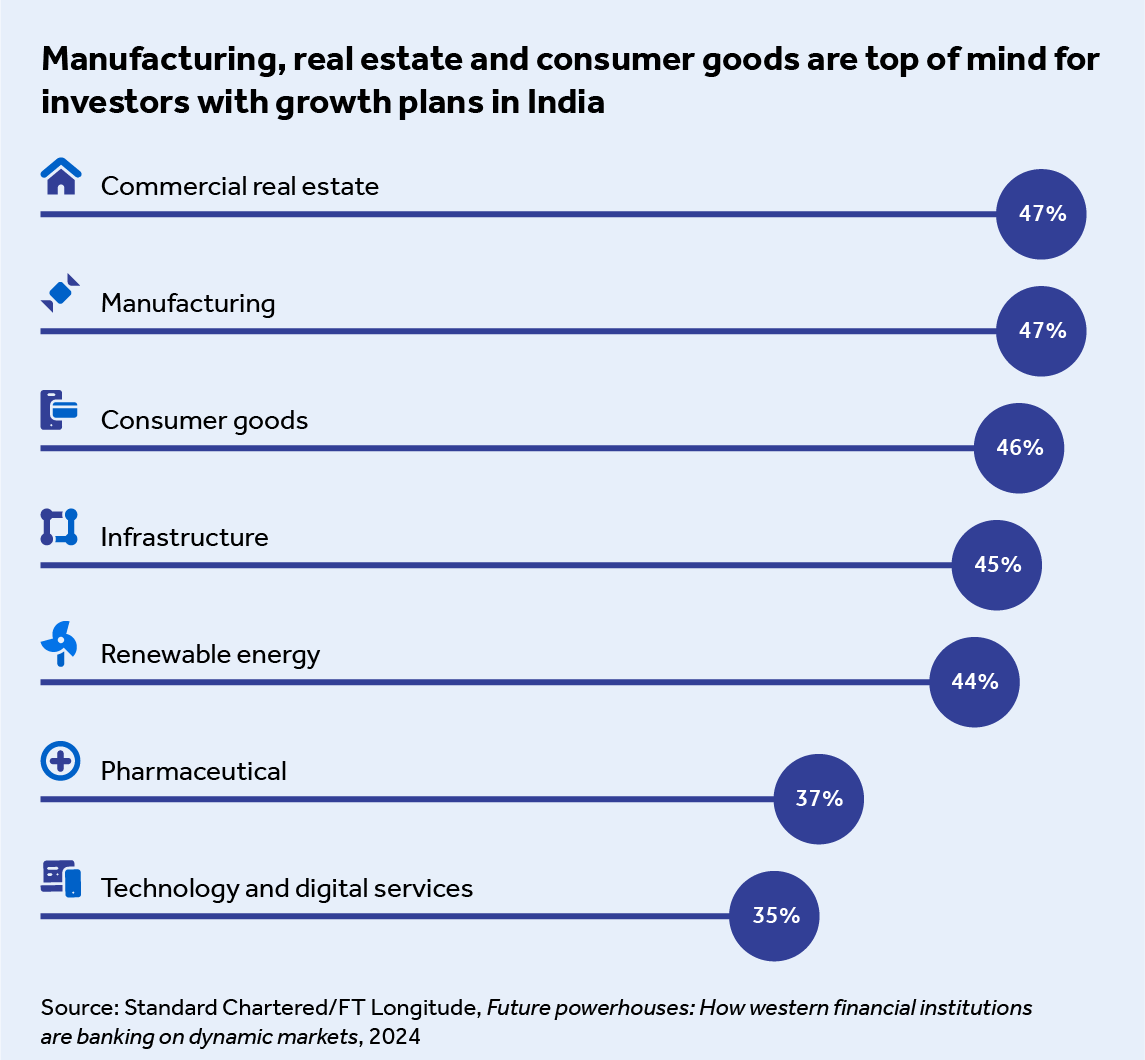

Investors in India are looking at a range of sectors, according to the research. The manufacturing sector is drawing particular attention: 47 per cent of investors with plans in India say it is one of the most attractive areas.

Companies including Apple have already switched production to India, and the country’s government now offers incentives worth $26bn a year to entice other manufacturers in 14 sectors of the economy.

Infrastructure is another sector that is attractive to investors: 45 per cent see opportunities here as India attempts to modernise its physical and digital networks to support its surging economy.

India has built 34,000 miles of national highways in the past 10 years, and has also invested in its digital networks. With dramatically improved connectivity, Indians routinely manage their finances on their mobiles, as state benefits are provided digitally.

There is also the consumer opportunity. India overtook Mainland China in 2023 to become the world’s most populous country, and increasing wealth has boosted the size of its “consumer class” to 473mn. The average Indian is 30 years old, which could explain why 46 per cent of investors in the research see consumer goods as an investment opportunity.

Investors make strategic moves into sustainability

India also offers an exciting opportunity for investment in sustainable infrastructure, says Amit Goel, Lead Portfolio Manager for Global Emerging Markets Strategy at asset manager Fidelity.

“With the US moving away from importing solar panels from China, the manufacturing value chain there is moving to other parts of Asia, including India,” he says. “Similarly, as electric vehicle penetration rates increase, I'm looking at India as well. We’re seeing companies begin to invest in batteries.”

In the research, 44 per cent of investors with plans in India see renewable energy as the most important sector to their future investment and development strategies.

That may come as a surprise to some. India has been criticised by campaigners for its relatively slow progress towards decarbonisation. Its target is to reach net zero carbon emissions only by 2070, and emissions from coal-fired electricity generation hit an all-time high in January 2024. But that partly reflects soaring energy demand from a larger, wealthier population. And India's renewables capacity is expanding, with the International Energy Association expecting it to double between 2022 and 2027.

According to Salsano, investing in the energy transition and infrastructure has become an imperative for India: “If you think about some of the impacts of climate change on countries such as India, it is crucial that investors direct funding to those markets to help fund the energy transition in particular.”

Renewable energy projects also bring job creation and technological advancement to rural areas, contributing to broader economic development. Investing in India's renewable energy sector allows western investors to capitalise on emerging market dynamics while contributing to global environmental and social goals.