Emerging no more: the era of dynamic markets is dawning

New research finds that the countries traditionally described as ‘emerging’ are drawing investors from more developed nations. Is it time to change the way we think about these markets?

They used to be known as emerging markets. But does it still make sense to use that term to describe Mainland China, the world’s second-largest economy? Or Brazil, one of the world’s leading exporters?

‘Emerging’, like ‘developing’, now feels outdated for a growing number of the countries that are typically described in this way. These are dynamic economies with rapid GDP growth and mature levels of integration into global trade and financial markets.

It is an important distinction that forms the basis of new research from leading international cross-border bank Standard Chartered. Its survey of 400 Europe- and Americas-headquartered financial institutions including asset owners, banks and investment managers shows that these companies’ appetite for exposure to these dynamic markets is growing. The dynamic markets of Asia, in particular, but also countries in other regions, are a major part of their investment plans for the next 12 months.

“Investors’ portfolios have traditionally been dominated by developed markets, and the United States in particular,” says Molly Duffy, Global Co-Head, Financial Institutions Coverage at Standard Chartered. “The US is not going to lose its title any time soon, but dynamic economies will continue to benefit from the amount of cross-border capital flowing into new markets across multiple sectors and asset classes.”

Financial institutions are enthusiastic about new markets

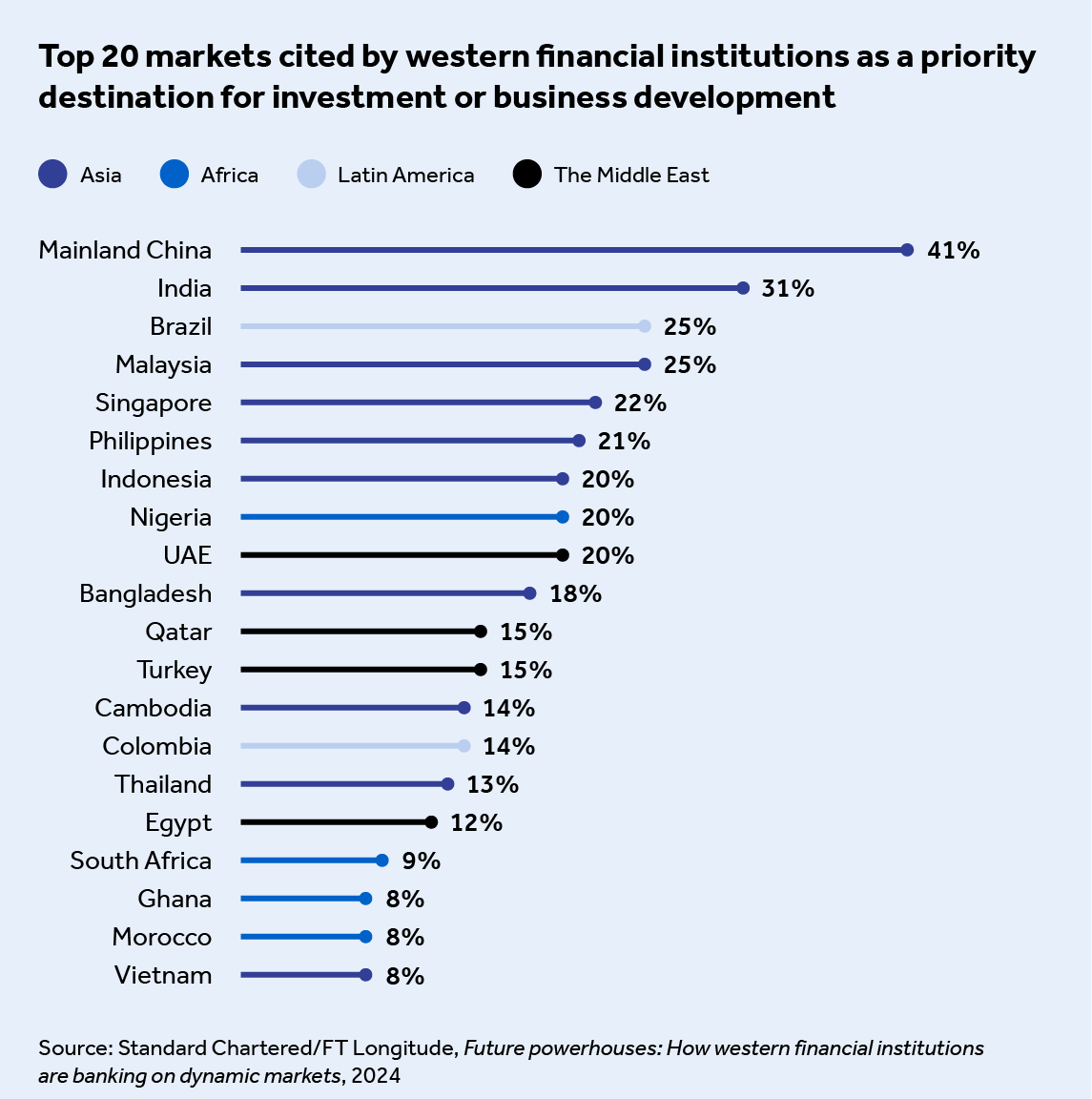

It looks like many of the dynamic markets will get that financing. According to the research, seven of the top 10 countries where investors are focusing their investment and development plans for the year ahead are in Asia, led by Mainland China, India and Malaysia. Four of the top 10 countries are also ASEAN member states.

But Brazil, the United Arab Emirates and Nigeria are also attractive to these investors. And beyond the top 10, investors are looking at dynamic markets from every corner of the globe: Turkey, Cambodia, Egypt and South Africa, for instance.

This is not surprising. The IMF predicts that over the next five years, the nations of what it describes as “emerging and developing Asia” will experience real annual GDP growth averaging between 4.5 per cent and 5.2 per cent; by contrast, it expects between 1.7 per cent and 1.8 per cent on average in “advanced economies”.

“Over the medium-term, India, the Philippines, Vietnam and Bangladesh are likely to maintain consistently higher growth rates, and growth in Malaysia and Indonesia should also be solid,” says Duffy. “The African growth story is equally distinctive: success stories such as Senegal and Cote d’Ivoire are a result of positive domestic reform and opening to global trade. We also see a lot of upside potential in Egypt.”

Investors like a compelling narrative

The narrative of these dynamic markets is capturing people’s imagination, says Vivek Bhutoria, Co-Portfolio Manager of the Global Emerging Markets Equity Fund at asset manager Federated Hermes.

Stories such as India’s general election, which was the biggest poll in history, are attracting huge interest. “There are good reasons for the excitement,” says Bhutoria. “With Prime Minister Modi having returned to power, there is political stability and the government can continue with the reforms of his first two terms.”

Bhutoria’s co-manager at Federated Hermes, Chris Clube, says that Malaysia is another example of a dynamic market with huge potential. “Malaysia is China-facing but also anglophone,” says Clube. “Chinese businesses are looking to set up there, but so too are American and European businesses that might previously have had manufacturing bases in Mainland China.”

The so-called China Plus One phenomenon – the idea that western companies and investors should avoid overdependence on Mainland China by increasing their exposure to other, often neighbouring economies – is another reason why there is growing demand for a wide range of dynamic markets. But Mainland China’s size and economic clout means it will inevitably continue to attract investment, and it still takes the top position in the research.

The buoyancy of dynamic markets reflects a shift in global economic trends. In these markets’ new era of economic significance, financial institutions will need to rethink their strategies and capitalise on their vast opportunities. “Banks are clearly at the forefront of supporting capital entering dynamic markets,” says Duffy. “We expect sizable investments in high-conviction asset classes in these economies to continue, representing unique opportunities to generate positive social, economic and financial impacts.”