Megatrends, profitability and integration: how DHL is expanding into dynamic markets

Dynamic markets are becoming increasingly attractive to investors from Europe and the Americas. How do they choose where to invest?

Multinational businesses manage their expansions across the world’s most dynamic markets in many ways. New research shows that there is strong appetite for investing in at least 20 markets in Asia, Latin America, Africa and the Middle East. Deciding which to prioritise can be difficult.

One organisation with experience of managing that process is DHL Group, the global logistics business, which now has a presence in 220 countries worldwide. Christian Garbe, DHL’s Global Head of Mergers & Acquisitions, works in close alignment with the company’s strategy team and corporate board to develop a strategic outline to 2030, which includes acquisitions in new markets.

“Our inorganic growth aspirations are a core pillar across DHL Group,” he says. “We see great potential, via M&A, to supplement our growth in freight forwarding, in our supply chain division, and also in the e-commerce space.”

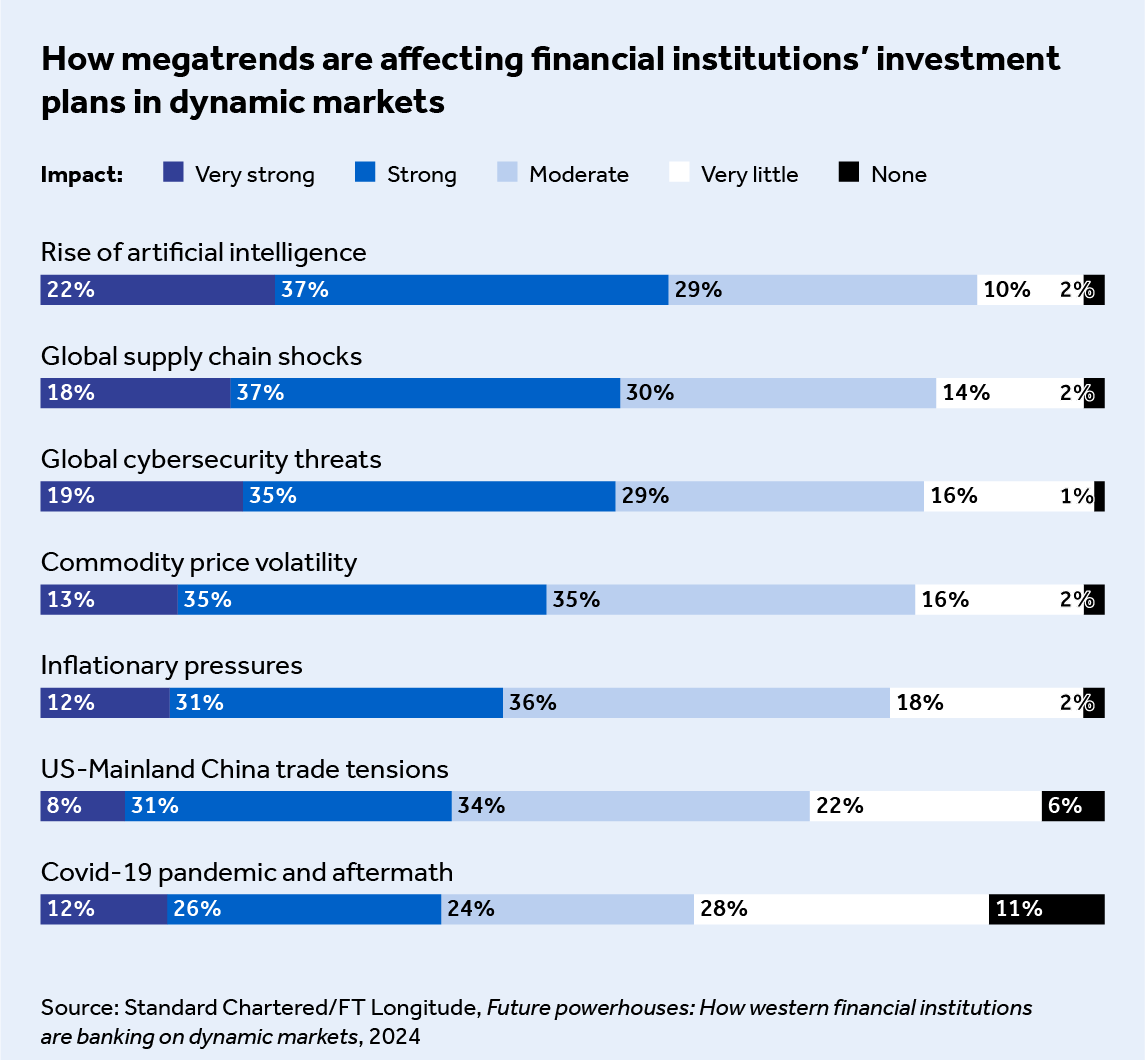

Megatrends are influencing investment

For DHL, identifying ‘megatrends’ helps it to understand which markets offer the greatest opportunities. These include the geopolitical tensions driving many businesses to diversify their supply chain activities, notably in Asia. “India is capturing quite a bit of that, as is south-east Asia,” says Garbe. “So those are markets where we are assessing the portfolio of capabilities we currently have.”

Asia is also a theme of new research conducted by multinational bank Standard Chartered that is based on a survey of 400 Europe- and Americas-headquartered banks, investment managers and asset owners. Seven of the top 10 countries where these investors are focusing their investment and development plans for the year ahead are in Asia.

Caroline Eber-Ittel, Standard Chartered’s CEO, France & Head of Banking & Coverage, Europe, says there has been a shift in global trade relationships and a subsequent reorganisation of supply chains. A completely globalised model is giving way to dynamic interregional trade exchanges. “This creates new opportunities for investment into alternative locations,” she says. “And it’s a trend we are seeing across our clients as they build diversification and resilience in their business models.”

Another megatrend is ‘near-shoring’, where companies move their supply chains closer, which increased following the Covid-19 pandemic’s disruption of lengthy and complex supply chain arrangements. “Near-shoring is one aspect of omni-shoring, or business customers looking for more diversified supply chains. This discussion brings countries such as Mexico, for instance, onto our radar screen, given its close proximity to the US,” says Garbe.

A third megatrend is the way countries are using their demographic strengths to speed up their economic expansion. “In countries where you have a young population and access to educated and well-trained workforces, that becomes very attractive,” says Eber-Ittel.

Turkey is one of those countries, and DHL has acquired its e-commerce business MNG Kargo in 2023. “As the gateway between Asia and Europe, Turkey is well placed to funnel trade flows between those regions. But it has also strongly emerged as a market in its own right during the past few years. It is profiting from GDP growth and has a young workforce with extremely capable people,” says Garbe. “The potential in the market is huge, which is why we started looking at it more thoroughly from a strategic perspective.”

Strategy, complexity and sustainability form DHL’s approach to investment

Once it had identified the relevant megatrends, DHL started to narrow down the potential acquisition targets.

“We always assess the attractiveness of potential M&A opportunities on the basis of three factors,” says Garbe. “The target has to be strategically attractive – to play into the core of our service portfolio across our different divisions. It needs to be financially accretive – to add to profitability to bolster the free cash flow profile of the group and yield superior returns versus alternative investments. And we’re also looking at the level of complexity involved in integrating the business into our portfolio of entities.”

There is another factor, and it is gaining importance. As DHL prioritises sustainability, including reducing the size of its carbon footprint, environmental, social and governance (ESG) themes are now an intrinsic element of every deal process. “ESG is part of the due diligence process in all of our M&A activities – we set up a workstream supported by our group’s dedicated experts in those fields,” Garbe says. “This is customised to the company and market, based on the availability of data, but ESG and sustainability are a focus for us in any given process.”

This is a disciplined approach to dynamic markets that encompasses big-picture themes, a thorough examination of individual deal opportunities and the increasingly important ESG lens. That careful approach is important, says Eber-Ittel. “When you’re investing in these economies, it’s about being able to get scale at a productive cost,” she says. “It’s about being really thoughtful about each investment – on a five-year view, but also 10 years, 15 years and beyond.”

Dynamic markets offer investors a generational opportunity

Get the strategy right, and the potential is huge. Garbe says DHL remains committed to expanding globally through further investments. “With the global perspective we have, we will focus on – and benefit from – the development of emerging markets in the years to come,” he says. “There are going to be lots of opportunities to further strengthen our footprint across our group.”

With the global perspective we have, we will focus on – and benefit from – the development of emerging markets in the years to come. There are going to be lots of opportunities to further strengthen our footprint across our group.

Christian Garbe, DHL’s Global Head of Mergers & Acquisitions

DHL will not be an outlier here, says Eber-Ittel. “We expect strong investments in dynamic markets,” she says. “Corporates are looking for sizable cross-border growth opportunities in our footprint markets, including Asia, Africa and the Middle East.”