How Malaysia is wooing overseas investors

Global trade tensions and opportunities in manufacturing and renewable energy are raising Malaysia’s investment profile among western financial institutions.

Dynamic economies worldwide are capturing the attention of western financial institutions, but new research shows that few are creating as much excitement as Malaysia. The south-east Asian nation, which is best known as a commodity exporter and manufacturing hub, is benefiting from companies’ determination to mitigate risks generated by ongoing trade tensions.

“Supply chain diversification is a really important global theme,” says Saif Malik, CEO, UK at Standard Chartered, who has lived and worked in Malaysia. “Geopolitical risk has prompted many companies to re-evaluate which markets they invest in, and that is playing out in places such as Malaysia. The country’s vibrant multiculturalism is a strong advantage on the world stage.”

Research conducted by Standard Chartered in Q1 2024 and based on a survey of 400 banks, investment managers and asset owners headquartered in Europe and the Americas, revealed that 25 per cent of respondents have plans to invest or grow business in Malaysia in the next 12 months. Out of all dynamic markets worldwide, only Mainland China and India scored more highly.

Money is already pouring into Malaysia. In 2023, foreign investment was RM329.5bn ($69.5bn), which was a record for the country and a 23 per cent increase year on year. GDP growth forecasts of 4.3 per cent in 2024 are bolstered by Malaysia’s “track record of fiscal prudence and a credible monetary policy framework”, according to the International Monetary Fund.

How Malaysia benefits from supply chain migration

“Malaysia is benefiting from supply chains migrating away from Taiwan and Southern China because it invested in creating an electronic supply chain base all the way back in the 1970s,” says Chris Clube, Co-Portfolio Manager of the Global Emerging Markets Equity Fund at asset manager Federated Hermes. “It has a long history of producing high-tech goods, so there is an ecosystem that already exists. Malaysia also benefits from being both English-speaking and Chinese-speaking.”

These attractions have led a number of manufacturing companies to establish themselves in Malaysia for the first time or to expand their existing activities, and the semiconductor sector is a particular area of focus. Examples include US chip giants Micron and Intel, and European semiconductor companies ams OSRAM and Infineon.

Malaysia’s northern region of Penang, whose free trade zone and busy shipping port attracted Intel in 1972, continues to offer attractive tax incentives to overseas investors. But southern Malaysia is also seeing increased investment, and the Malaysian semiconductor industry as a whole has shifted its value chain towards more advanced technology. In 2023, Malaysia accounted for more US microchip imports than any other country in the world.

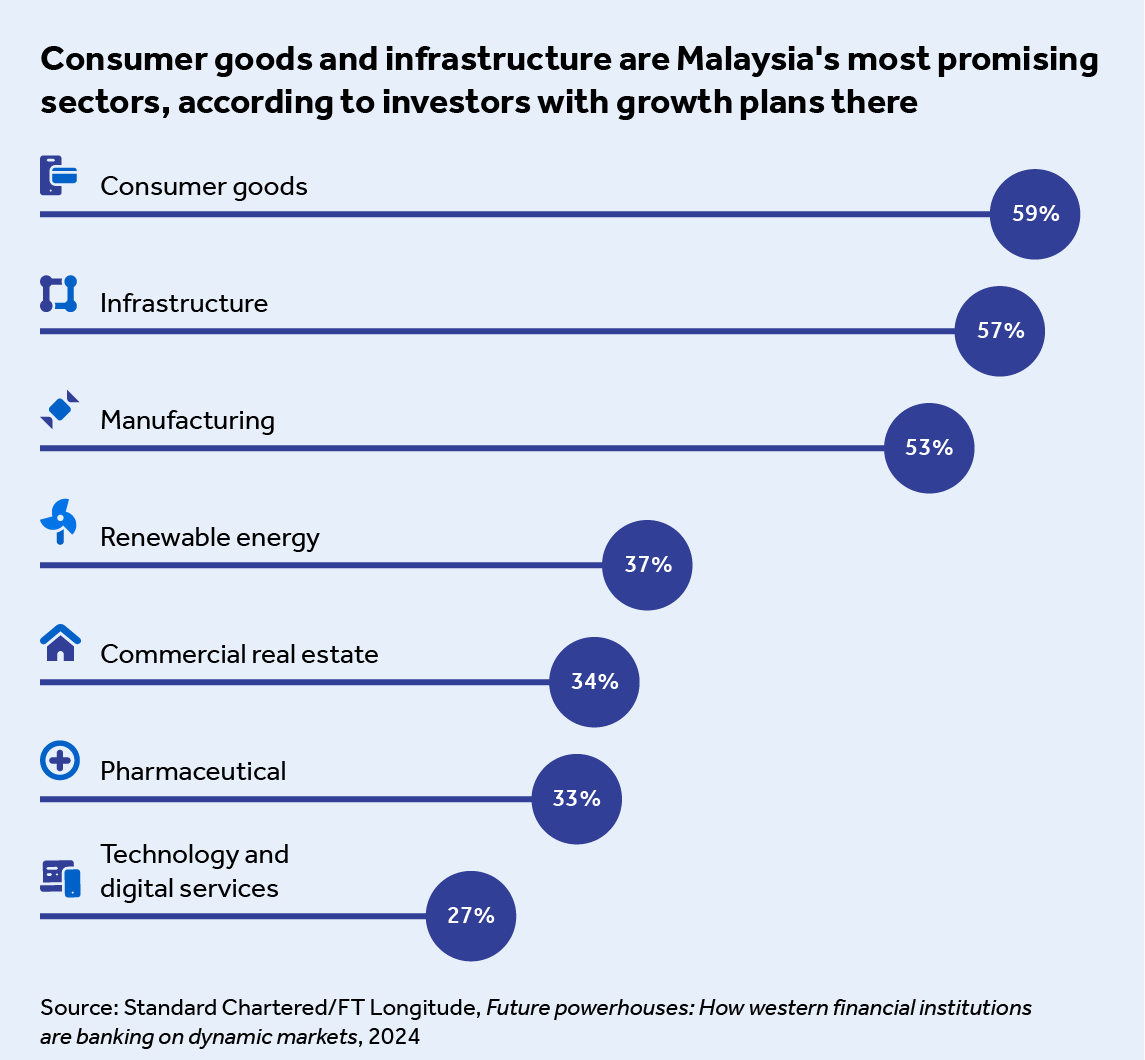

Manufacturing does appear to be an ongoing priority for investors. In the Standard Chartered research, 53 per cent of investors who are intending to invest in Malaysia say that manufacturing is one of the most attractive opportunities.

Green policies and political support are attracting investors

Investors are also looking at other sectors. For example, 55 per cent see opportunities to invest in the infrastructure sector as Malaysia’s economy expands rapidly. And 42 per cent see potential in renewable energy. Malaysia has one of the most ambitious decarbonisation plans in Asia, with a target of net zero emissions by 2050.

Consultancy McKinsey has identified the sustainability opportunity in Malaysia as one of Asia’s most attractive, saying the country has a strong position in areas such as carbon capture and storage, renewables, biofuels and hydrogen: “Malaysia has a significant opportunity to become a major player in green business growth and sustainable development in Asia.”

Policymakers are trying to exploit this potential, according to Clube. “The state governments are very good at making overtures towards international businesses,” he says. “They can provide very favourable terms – whether on land, on credit or on other incentives to set up in the country.”

Investors will hope that the central government also continues to offer this kind of support. Malaysian Prime Minister Anwar Ibrahim has moved in that direction by launching the New Industrial Master Plan 2030, which aims to increase the manufacturing sector’s GDP by 6.5 per cent a year through to 2030, and the National Energy Transition Roadmap, which seeks to restructure the economy along more sustainable lines.

Such initiatives can be crucial in underpinning investors’ confidence. According to the research, 34 per cent of investors in Malaysia say that political stability is one of the criteria they consider when they select investment and business development destinations. Only quality of infrastructure, which was chosen by 37 per cent of investors and where Malaysia is also investing – is a bigger concern.

By capitalising on its strategic advantages in manufacturing and green technologies, Malaysia is positioning itself as an increasingly attractive destination for western financial institutions.